Case File 022: The Case of Holiday Cheer — When Deductions Go Too Far

Filed under: CPA Prep & Festive Finances

The office was buzzing with holiday spirit. The client had thrown a lavish party, handed out expensive gift baskets, and donated to three charities. But when Detective Debit opened the books, Figgy hissed. Something didn’t add up.

“Everything’s deductible, right?” the client asked, sipping cocoa. Detective Debit shook her head. Not quite.

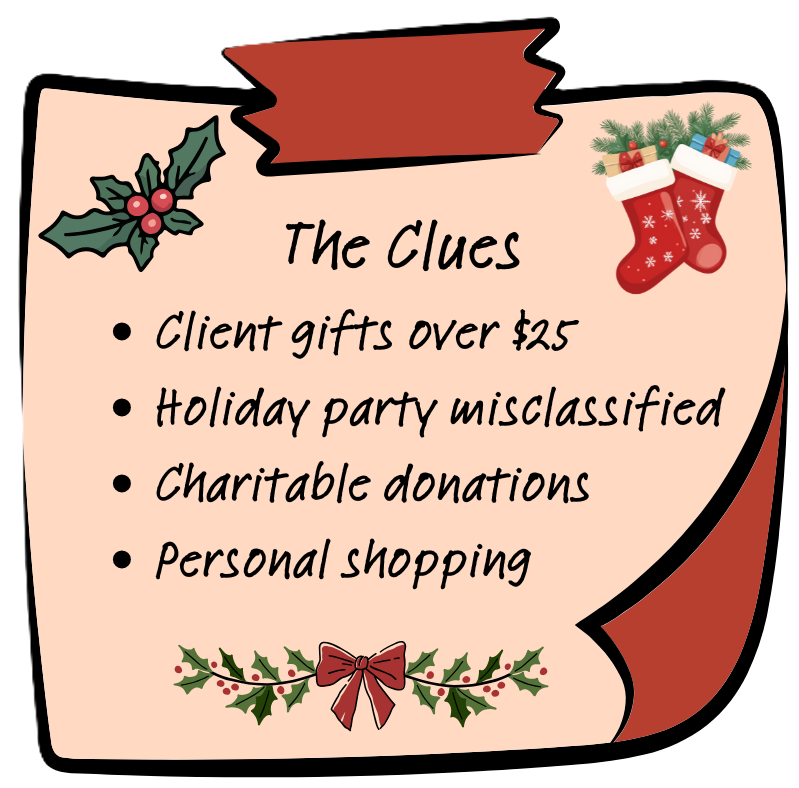

The Clues

Client gifts over $25 booked as deductible expenses

Holiday party coded as “client entertainment” instead of staff party

Charitable donations missing receipts or not to qualified organizations

Personal holiday shopping mixed into business credit card charges

The Twist

The IRS doesn’t share Santa’s generosity. Only certain holiday expenses qualify. Misclassify them, and you risk losing deductions—or worse, raising red flags.

Detective Debit’s fix: reclassify staff party as deductible, cap client gifts at $25, verify charities, and separate personal spending from business accounts.

Figgy’s tail twitched at the phrase “client entertainment.” She’s seen that disguise before. Behind the festive labels lurked a trail of misclassified cheer, and she wasn’t about to let it slide.

The Takeaway

Celebrate generously but track carefully. Your CPA will thank you for separating business cheer from personal joy.

Need Backup?

Declutter Your Books LLC ensures your holiday generosity doesn’t turn into a tax-time mystery.

Figgy’s nose never misses a trail…. or a treat!

Case File 023 — The Case of the Missing Reports.

Detective Debit uncovers why CPAs need more than a shoebox of receipts to solve the tax puzzle.