Case File 024: The Case of Boxing Day Balance — When December Books Stay Unwrapped

Filed under: CPA Prep & Holiday Themes

December 26. The gifts were unwrapped, leftovers packed away. But the books? Still untouched. Detective Debit spotted a pile of receipts under the tree.

Figgy supervised the “boxing up” of statements, tail twitching impatiently.

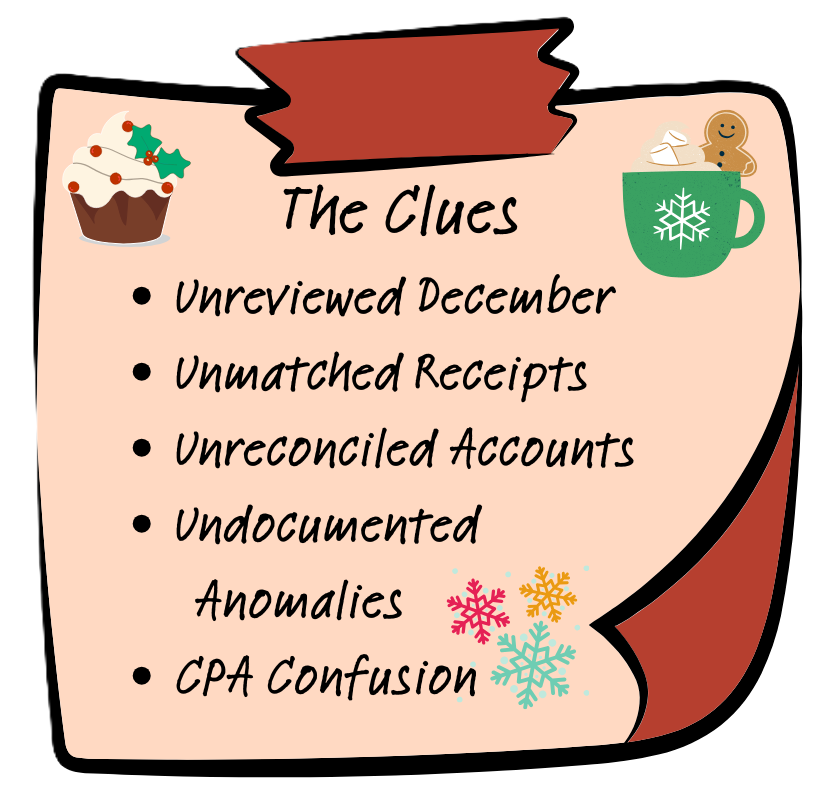

The Clues

December transactions not yet reviewed

Receipts scattered, not matched to expenses

Accounts unreconciled for year‑end

Anomalies noted but not documented

CPA asking, “Why is December missing?”

The Twist

Boxing Day isn’t just about sales—it’s about boxing up your books. While others chase clearance deals, Detective Debit and Figgy are chasing down missing December transactions. Wait until January, and you’ll be racing against deadlines with no time to fix errors.

Detective Debit’s fix: Reconcile December now. Box up receipts, balance accounts, and document anomalies before the year closes. Give your CPA the full story—not a scavenger hunt.

Figgy may love a mystery, but she prefers her clues sorted by category.

The Takeaway

A balanced December sets the stage for a smooth tax season. When your books are boxed and your reports aligned, your CPA can shift from damage control to strategic planning.

That’s how you turn financial fog into festive foresight—with Figgy’s paw of approval.

Need Backup?

Declutter Your Books LLC helps you box up your books neatly, so your CPA gets a gift they’ll actually appreciate. No more shoeboxes. No more guesswork.

Just clean reports, reconciled accounts, and a satisfied Figgy snoozing beside the final page.

Case File 025 — The Lump Sum Ledger

The loan was legit. The payments were made. But the books? They told a different story. Detective Debit investigates the case of notes payable recorded as one big monthly blob—and reveals why splitting principal and interest matters more than most business owners realize.