Case File 025: The Lump Sum Ledger — When Loan Payments Lie

Filed under: Notes Payable Neglect & Interest Evasion

The books showed a neat monthly payment: $850 to the equipment lender. Detective Debit raised an eyebrow: “How much of that is interest?” The client blinked. “Uh… all of it?”

Figgy’s whiskers twitched — she doesn’t buy lump sums without proof.

The Clues

Monthly loan payments recorded as a single expense

No breakdown between principal and interest

Notes Payable balance that never decreases

Interest expense missing from the Profit & Loss

The Twist

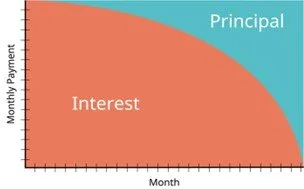

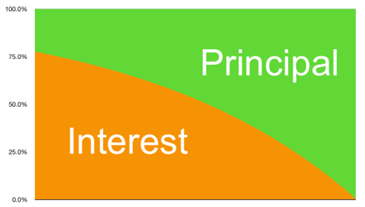

When loan payments are booked as one lump sum, the books lie. The principal portion should reduce the liability on the Balance Sheet, while the interest belongs on the P&L.

But when everything’s dumped into “Loan Payment” or “Bank Charges,” you lose visibility—and accuracy.

And here’s the kicker:

Applying the full payment to principal inflates assets and net income, which can make your business look more profitable than it really is—and that can lead to higher taxes.

Skipping the interest expense means missing a legitimate tax deduction, so you may end up paying more than you owe.

Detective Debit’s fix? Pull the amortization schedule, split each payment properly, and track the loan balance like a hawk.

Figgy flicked her tail:

“Separate the clues —

principal here, interest there.”

Takeaway

Loan payments aren’t just expenses—they’re a mix of debt reduction and cost of borrowing. Always separate principal and interest.

Use a Notes Payable account to track the balance, and make sure your books reflect what you owe and what you spend.

Need Backup?

If your loan payments are hiding the truth and your Balance Sheet isn’t budging, I can help. We’ll untangle the entries, set up proper tracking, and make sure your books tell the whole story—interest included.

What looks like a neat monthly payment can actually be a fleece disguised as a windfall.

Figgy’s nose twitches when the ledger doesn’t balance — and she’s usually right.

The best defense is clarity: contracts that spell out terms, amortization schedules that guide entries, and books that separate debt from cost.

When you track the truth, you protect both your profits and your peace of mind.

Figgy’s paw of approval only comes when the ledger tells the whole truth.

Special Investigation: The Cleanup Con

Five years of books. Four accounts. Three hundred transactions a month. A prospect waves a generous fee, but Figgy’s nose twitches: “This doesn’t smell right.” Sometimes the biggest mess isn’t in the books — it’s in the client’s story.