Case File 026: Subscription Sneak Attacks — When Recurring Charges Hide in Plain Sight

Filed under: Vendor Vigilance & Cash Flow Leaks

January resolutions bring fresh starts… and sneaky renewals. Detective Debit spotted vendor charges repeating like clockwork, but the client swore they’d canceled.

Figgy pawed at the ledger: “These aren’t gifts — they’re leaks.” Subscription creep drains cash flow one unnoticed charge at a time.

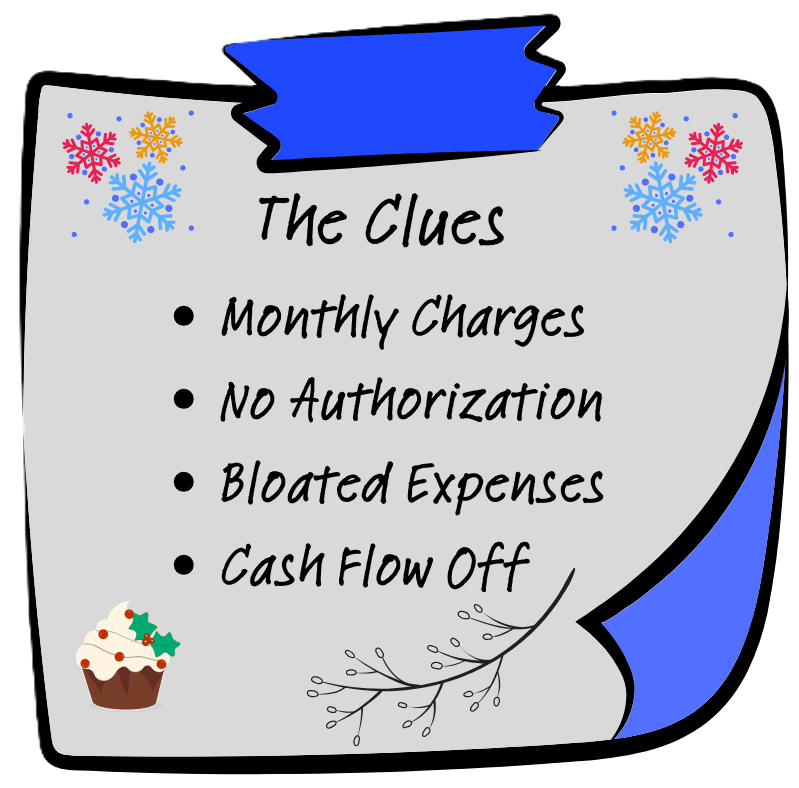

The Clues

Recurring vendor charges showing up monthly

No signed contract or renewal authorization on file

Expense accounts bloated with small, unexplained charges

Cash flow projections consistently off by a few hundred dollars

The Twist

Subscriptions are the silent siphons of business accounts. Auto‑renewals slip past distracted owners, and vendors rely on inertia to keep billing. Wait too long, and you’ve lost months of cash to services you don’t use.

Detective Debit’s fix: audit recurring charges quarterly, cancel unused services, and require written confirmation for renewals.

Figgy flicked her tail: “Cancel the noise, keep the signal.”

The Takeaway

Recurring charges can look harmless, but they add up fast. Spotting them early protects cash flow and keeps expenses aligned with actual needs.

Need Backup?

Declutter Your Books LLC helps you identify subscription creep, cancel unused services, and keep your expense accounts lean.

Figgy’s nose never misses a trail.

Subscriptions thrive on neglect. Figgy’s whiskers twitch when she sees the same charge month after month. The best defense is vigilance: review, confirm, and cut.

Case File 027: Payroll Phantom Entries

Ghost employees haunting your payroll? Detective Debit asked, “Who’s Sam?” The owner blinked. Figgy’s tail lashed — phantom entries were stealing paychecks. Shine a light on payroll, and the ghosts vanish.